A pay cycle change is a switch in the frequency in which an employee is paid. Employees are paid either on a biweekly or monthly cycle. Simply put, a pay cycle change is when an employee who is paid biweekly switches to monthly, or vice versa.

Pay cycle changes are triggered by WFA actions that change key information on an employee’s job record. The need to make such changes is normal and so is the resulting pay cycle change. For example, if a biweekly paid employee is promoted to an exempt position that is paid monthly, the WFA action of entering the promotion will result in a pay cycle change. Other, more complex examples can result in pay cycle changes, but this lays the foundational understanding for pay cycle changes.

Key Fields Triggering Pay Cycle Changes

| WFA trigger fields | things to know |

|---|---|

| pay group | The pay cycle is connected to the Pay Group; if the Pay Group changes, the pay cycle could change. |

| FLSA status1 | This field controls whether an employee is exempt or non-exempt from overtime pay. As a general rule, exempt employees are paid monthly, and non-exempt employees are paid biweekly. If the FLSA status changes from exempt to non-exempt or vice versa, the Pay Group and pay cycle will ultimately change. |

| fte | FTE changes may result in an exemption status (FLSA) change. (e.g., An FTE decrease causes the weekly salary earned to drop below the exemption threshold, requiring the FLSA status to change to non-exempt, thus changing the Pay Group and pay cycle.) |

| job code |

If the Job Code changes due to a promotion, demotion, reclassification, or transfer, and the FLSA Status of the new job code differs, this will result in a Pay Group and pay cycle change. |

1 The Fair Labor Standards Act (FLSA) establishes basic wage standards (e.g., minimum wage, overtime pay, recordkeeping) and protects employees. These rules apply to non-exempt employees; exempt employees are excluded from FLSA rules based on set criteria.

Common

Scenarios

| ID | SCENARIO | NOTES | THINGS TO KNOW |

| 1 | Employee Promotion |

|

|

| ID | SCENARIO | NOTES | THINGS TO KNOW |

| 2 | Job Reclassification |

|

|

| ID | SCENARIO | NOTES | THINGS TO KNOW |

| 3 | Change in percent of time/FTE |

|

|

| ID | SCENARIO | NOTES | THINGS TO KNOW |

| 4 | Resolve a pay cycle conflict |

|

|

| ID | SCENARIO | NOTES | THINGS TO KNOW |

| 5 | Request a Pay Group override via UCPC Case |

|

|

Non-Applicable

Scenarios

Not all WFA actions trigger pay cycle changes. Although there are too many to list that do not impact an employee’s pay cycle, the following is a list of common WFA transactions that alone are not expected to result in a pay cycle change.

| ID | SCENARIO | THINGS TO KNOW |

| 1 | A pay rate change due to merit increase or equity |

|

| ID | SCENARIO | THINGS TO KNOW |

| 2 |

Data changes for non-Pay Group impacting fields like: |

|

| ID | SCENARIO | THINGS TO KNOW |

| 3 | Promotion, reclassification, appointment modification, etc. where no FLSA change occurs |

|

Process Change Management

You need to take proactive steps to effectively manage your employees' pay cycle change.

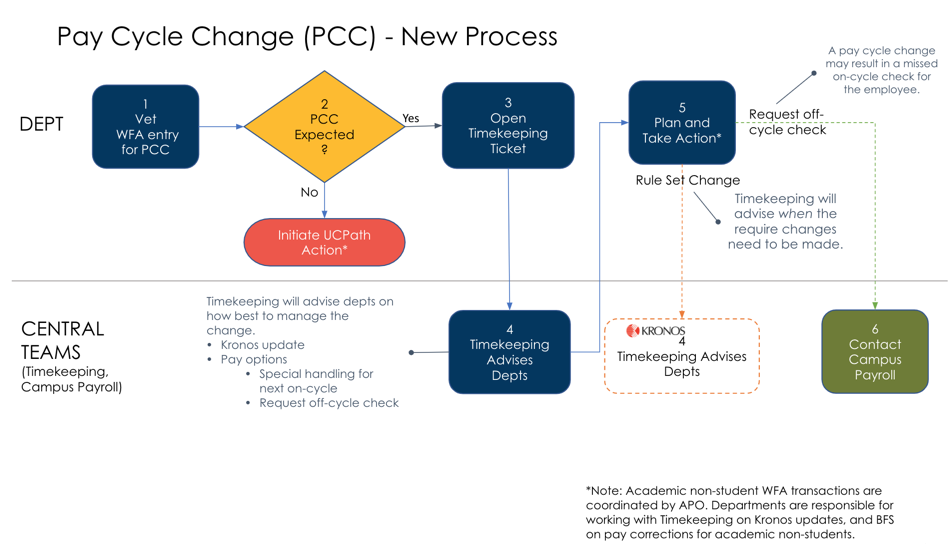

Below are the process map and step detail to help guide you. Each step on the map corresponds to the Process Change Management steps below.

Before initiating your WFA action, review the expected changes to analyze if it will result in a pay cycle change for the employee.

| Responsible party |

Department Transactional User |

|---|---|

| inputs |

WFA documentation (e.g., job reclassification letter, job promotion email, academic appointment modification memo, etc.) |

| procedural tasks |

Note: If no pay cycle change is identified, initiate the WFA transactions as per normal processing 1WFA transactions for academic non-student positions are managed centrally by AP-Path. Departments are responsible for reviewing key fields to identify if a pay cycle change will occur and initiating appropriate actions in steps 2-6 below, as needed. |

| outputs |

Understanding of WFA transactions, possible pay cycle change impact |

Support

If you need help with this step, please contact the following resources.

- Staff and student staff: ucsb.service-now.com/hr

- Academic non-students & ASEs: ap-path@ucsb.edu

Not all WFA transactions result in a pay cycle change. However, if you analyze the job changes, and identify a necessary pay cycle change, determine the next steps prior to initiating the WFA transaction.

| Responsible party |

Department Transactional User |

|---|---|

| inputs |

Job Data change review on job record (Job Code, FTE, and/or FLSA) |

| procedural tasks |

Step 1: Determine the action type required to implement the change in UCPath: Step 2: Verify the job code reports hours in Kronos (Staff jobs [except BYA] Step 3: If the job has a pay cycle change and: |

| output |

Understanding if you need to manage the pay cycle change |

Support

If you need help with this step, please contact the following resources.

- Staff and student staff: ucsb.service-now.com/hr

- Academic non-students & ASEs: ap-path@ucsb.edu

There are several variables and considerations for effectively managing a pay cycle change. Instead of trying to educate everyone on all of the ins and outs, the Timekeeping team can best promote the successful management of pay cycle change actions when you open a support ticket.

| Responsible party |

Department Transactional User |

|---|---|

| inputs |

|

| procedural tasks |

Open a pay cycle change management ticket with Timekeeping, who will advise key actions to take, provide employee payment options and provide your next steps

|

| outputs |

|

Support

If you need help with this step, please contact the following resources.

- Kronos Timekeepers & Payroll Managers: ucsb.service-now.com/it

The Timekeeping team is at the center of understanding the considerations for effective pay cycle change management. Timekeeping will advise you of key actions to take, when they should be executed, and payment options to minimize or avoid missed pay.

| Responsible party |

Timekeeping Team |

|---|---|

| inputs |

|

| procedural tasks |

Analyze pay cycle change implications and provide action steps and timing guidance:

|

| outputS |

|

Support

If you need help with this step, please contact the following resources.

- Kronos Timekeepers & Payroll Managers: ucsb.service-now.com/it

Now that you have identified a pay cycle change, determined the WFA actions needed, and received advice from Timekeeping about key actions to effectively manage the pay cycle changes if applicable, you must plan and act. You may create calendar reminders as some actions may be time-sensitive (e.g., changing Kronos rule set, ensuring changes are not inputted during the payroll processing freeze periods), send communication to the employee, open a payroll ticket, etc.

| Responsible party |

Department Transactional User |

|---|---|

| inputs |

Action items from analysis and Timekeeping team consultation |

| procedural tasks |

Analyze pay cycle change implications and provide action steps and timing guidance:

|

| outputS |

|

Support

If you need help with this step, please contact the following resources.

- Kronos Timekeepers & Payroll Managers: ucsb.service-now.com/it

Resolving Pay Processing Conflicts

Pay processing conflicts are applicable to employees who have multiple jobs simultaneously. Pay processing conflicts occur when an employee’s concurrent jobs have different FLSA status and/or pay cycles. This topic is a part of pay cycle change management because resolving a pay processing conflict often leads to a pay cycle change to be managed.

RESOLVE these conflicts, by refering to the following resources:

Case Study Examples:

Review the case studies below to learn how pay processing conflicts can be created.

Case No. 1

A classic example of a pay processing conflict - when a staff-student employee concurrently adds an academic job. Both the FLSA status and pay cycles are in conflict.

| JOB RECORD - Nbr | FLSA STATUS | PAY CYCLE | EMPLOYEE GROUP |

| Staff-Student - 0 | Non-exempt | Biweekly | Staff |

| TA - 1 | Exempt | Monthly | Academic |

Case No. 2

The classic pay processing conflict scenario may have only an FLSA status conflict. For example, a student employee (Biweekly Staff, FLSA: non-exempt) is concurrently hired as a Reader2 (Biweekly Academic, FLSA: exempt).

| JOB RECORD - Nbr | FLSA STATUS | PAY CYCLE | EMPLOYEE GROUP |

| Staff-Student - 0 | Non-exempt | Biweekly | Staff |

| Reader - 1 | Exempt | Biweekly | Academic |

2The Reader academic title, which is FLSA exempt but paid biweekly, is the exception to academic jobs, which are primarily FLSA exempt and paid monthly.

Case No. 3

When a Reader job is involved, it is possible to have only a pay cycle conflict with other concurrently held academic jobs. For example, an academic student employee who has a Reader job (Pay cycle: Biweekly) and then is concurrently hired, for example, as a Teaching Assistant or GSR (Pay cycle: Monthly).

| JOB RECORD - Nbr | FLSA STATUS | PAY CYCLE | EMPLOYEE GROUP |

| Reader - 0 | Exempt | Biweekly | Staff |

| TA - 1 | Exempt | Monthly | Academic |

Resources & References

Pay Cycle Change Checklist

Use the Pay Cycle Change Checklist Google doc if you’ve determined that your WFA action will or has caused a pay cycle change for your department’s employee.

Frequently Asked Questions

Consult the Pay Cycle Change FAQs page to answer your general and change management questions.

Glossary

Use the Pay Cycle Change Glossary for key definitions and acronyms.

UCSB Pay Groups

Use the UCSB Pay Groups link to determine FLSA and pay status of each job type.